The lowdown on how demerit points work and their affect, if any, on your auto insurance premiums.

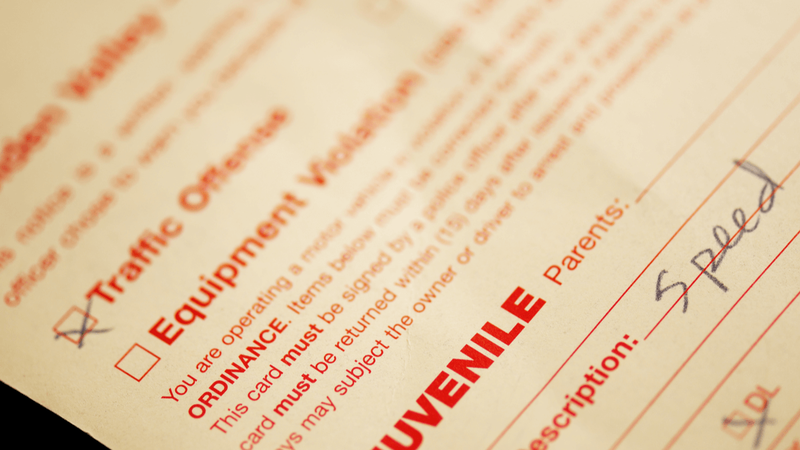

There are three things that suck about traffic tickets: the fine, the impact the ticket has on your auto insurance rate, and the demerit points tacked on to your driving record. The first two are typically top of mind when a driver gets pulled over, while the latter is often misunderstood, especially as to how it affects insurance.

Do demerit points affect your auto insurance premium?

In short, no. Demerit points do not affect your auto insurance rates. It’s the ticket, and the severity of the ticket, that affects your premium.

Demerit points are your province’s way to keep tabs on drivers who repeatedly ignore the rules of the road. Demerit points are used to score your driving record, and if you get enough of them, you run the risk of losing your licence. If your province suspends your licence because you have too many demerit points, the suspension will also affect the auto insurance rate you pay once it is reinstated.

How many demerit points will result in a licence suspension?

Each province’s rules vary and what follows is a summary for Alberta, Ontario, and Quebec. However, what is consistent across all three of these provinces is that your licence will not be suspended without notice. You’ll be sent a cautionary letter as you accumulate demerit points warning you that you’re approaching the maximum number of points permitted.

How demerit points work in Alberta

| Type of Driver’s Licence | Licence Suspended | |

|---|

| Fully licensed drivers | At 15 demerit points your licence will be suspended for one month. | |

| Graduated Driver’s Licence holders | At eight demerit points your licence will be suspended for one month. | |

| | | |

Steer clear of high auto insurance premiums

Your driving record matters. It is one of the most influential factors in determining your insurance rate. Sure, there are others like where you live, your insurance history, and the type of car you drive but your driving record and history indicate ohow you are when behind the wheel. Drive carefully and mind the rules of the road to keep your car insurance premiums low by avoiding tickets in the first place.